Venture capital investment

Venture capital investments provide an opportunity to diversify the investor’s funds in different market sectors and have a good capitalization in the future.

Designed for investors who are willing to invest in the long term and want to have a continuous flow of passive income in the future without any additional investment. Venture capital investments include IPOs, Pre-IPOs, start-ups that already have activity. The risk profile of venture capital investments can be different depending on the project and activity.

Designed for investors who are willing to invest in the long term and want to have a continuous flow of passive income in the future without any additional investment. Venture capital investments include IPOs, Pre-IPOs, start-ups that already have activity. The risk profile of venture capital investments can be different depending on the project and activity.

Venture capital investments include IPOs, Pre-IPOs, start-ups that already have activity. The risk profile of venture capital investments can be different depending on the project and activity.

Ideal for investors who want to invest, for example, only in the territory of the EU and USA, or investors who trade abroad.

Ideal for investors who want to invest, for example, only in the territory of the EU and USA, or investors who trade abroad.

Venture Capital Returns is a dividend payout of 35% of the company’s return and an active increase in the deposit ratio by 3-4 times over 2 years.

The advantage of venture capital investment is to own a ready-made business, without additional investments and with the understanding that in the future the client can become the owner of a share in a large business, which will bring profit monthly, Customer’s commensurate initial deposit and more.

Current offers

for venture capital investments

Project

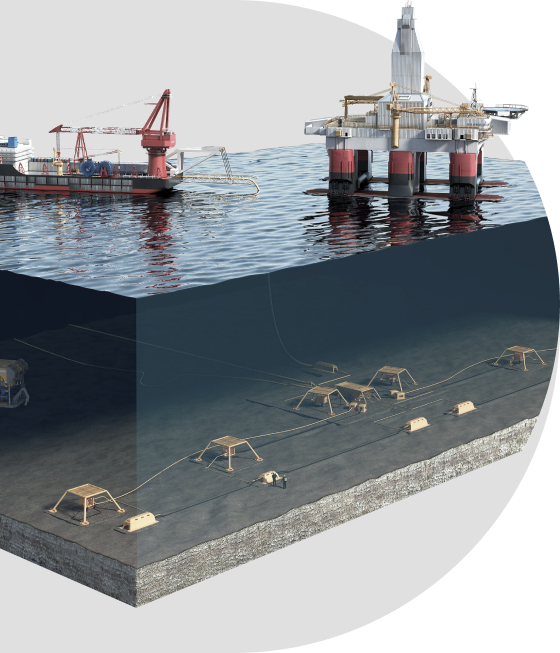

Hydrocarbon deposit on the Grenada shelf

Global Petroleum Group (GPG) was founded in Grenada in 2003.

It has a Production Sharing Agreement (PPA) and a development licence for the production of hydrocarbons in Blocks D on the Grenada shelf. GPG signed the PSA and obtained a license in 2013, the license allows exploration, development, production, sale and export of hydrocarbons from the licensed area.

It has a Production Sharing Agreement (PPA) and a development licence for the production of hydrocarbons in Blocks D on the Grenada shelf. GPG signed the PSA and obtained a license in 2013, the license allows exploration, development, production, sale and export of hydrocarbons from the licensed area.

GPG needs financing for the second drilling campaign of up to $500 million in debt and/or stock.

GPG needs funding for the 2nd drilling campaign of up to $500 million in debt and/or stock.

Funds will be used to further confirm the company’s identified reserves, as well as to expand the resource base around the satellite fields. The company’s valuation is well below its net present value ($5 billion) and corresponds to the most recent net worth estimate, which will allow the investor to more than triple his investment over a period of 18-24 months.

Returns:

12,5% / a year

Investment term:

6 months. / 12 months.